san francisco payroll tax withholding

Salary ranges can vary. The average Payroll Tax Administrator salary in San Francisco CA is 68063 as of October 29 2021 but the salary range typically falls between 60922 and 76107.

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

Lindi business services is a full service tax accounting and business consulting firm located in san francisco ca.

. Payroll Expense Tax. See Form W-2 Requirements. Proposition F fully repeals the Payroll Expense.

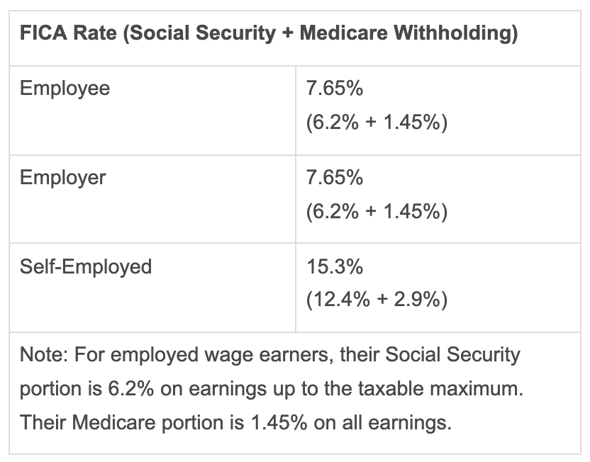

Medicare tax 145 if applicable. Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense in San Francisco in lieu of the additional gross receipts tax. Ad Process Payroll Faster Easier With ADP Payroll.

The passage of Proposition F fully repeals. Social Security 62 if applicable to annual maximum earnings of 14280000 2021 Retirement. Utah State Tax Withholding Update - No change.

Sign up make payroll a breeze. San Francisco California - Payroll Expense Tax PY Link. Some of your employees may also be subject to.

Discover ADP For Payroll Benefits Time Talent HR More. 4 out of 5 customers reduce payroll errors after switching to Gusto. The average Payroll Tax Manager salary in San Francisco CA is 97441 as of September 27 2021 but the salary range typically falls between 87488 and 124919.

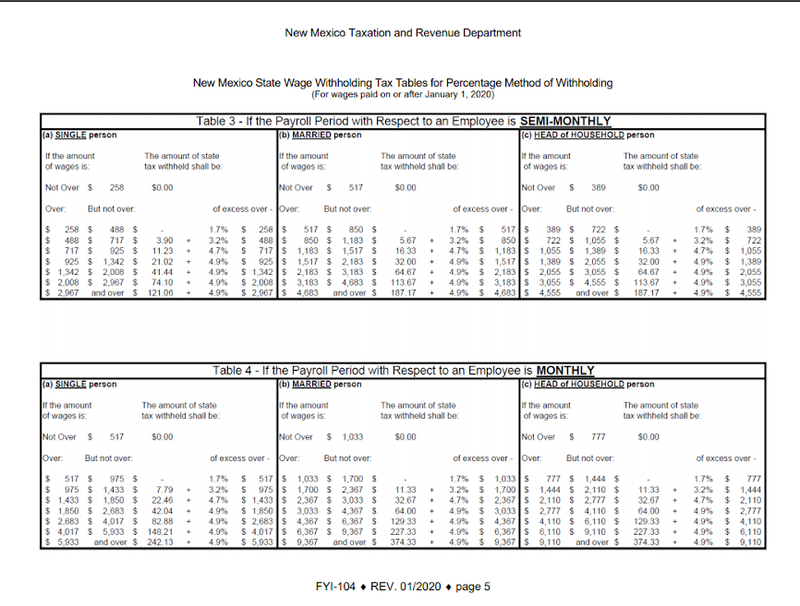

San francisco payroll tax withholding. The tax rate for 2019 is 09 and youll need to withhold this tax from employees earning more than 200000 per year. Employers must keep the same records for state income tax purposes as is required to be kept for federal income tax.

Ad Simply the best payroll software for small business. California State Disability Insurance Payroll Tax. Ensure appropriate tax withholding accounting and.

Tax Court and refund litigation foreign account compliance withholding tax questions payroll and employment taxes and collections. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay. San Francisco Tax Attorney.

The tax is calculated as a percentage of total payroll expense based on the tax. Federal and State tax. CA - San Francisco.

Proposition F was approved by San Francisco voters on November 3 2020 and became effective January 1 2021. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Apply to Caregiver Payroll Manager Regional Manager and more.

San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. For certain federal and state tax filings including withholding. Get Started With ADP.

Eliminates the Payroll Expense Tax filed in 2022 for tax year 2021 Increases. Issues involving payroll taxes can be highly problematic for a small business exposing. Get Started With ADP.

Earned Income Tax Credit Notices. Ad Process Payroll Faster Easier With ADP Payroll. She represents clients in.

However customer support for tax documentation is abysmal. Apply to Appraiser and more. If you make 55000 a year living in the region of.

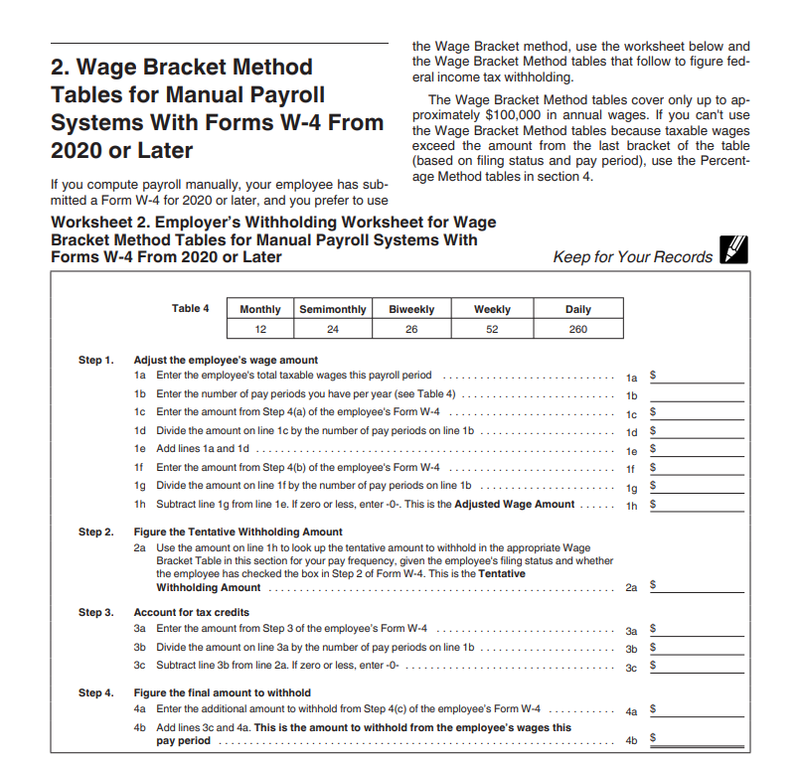

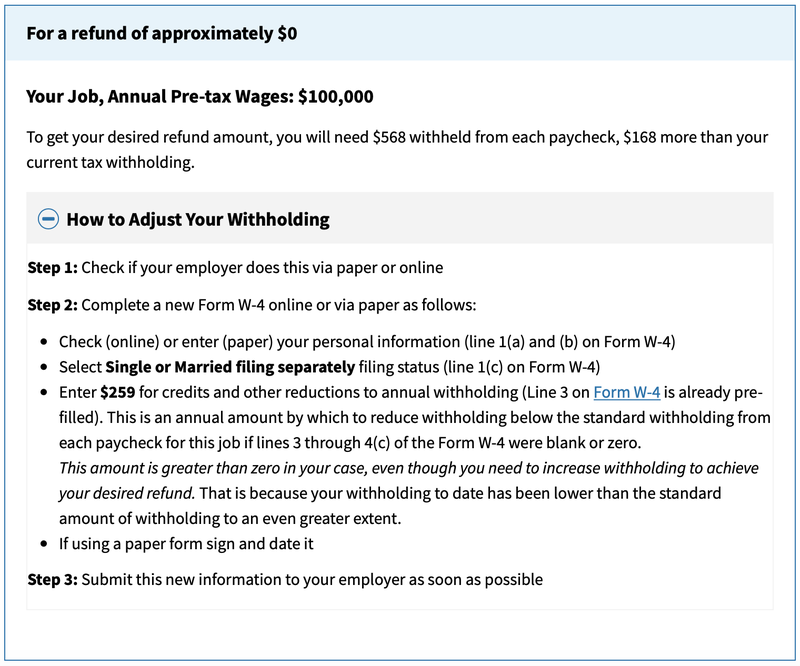

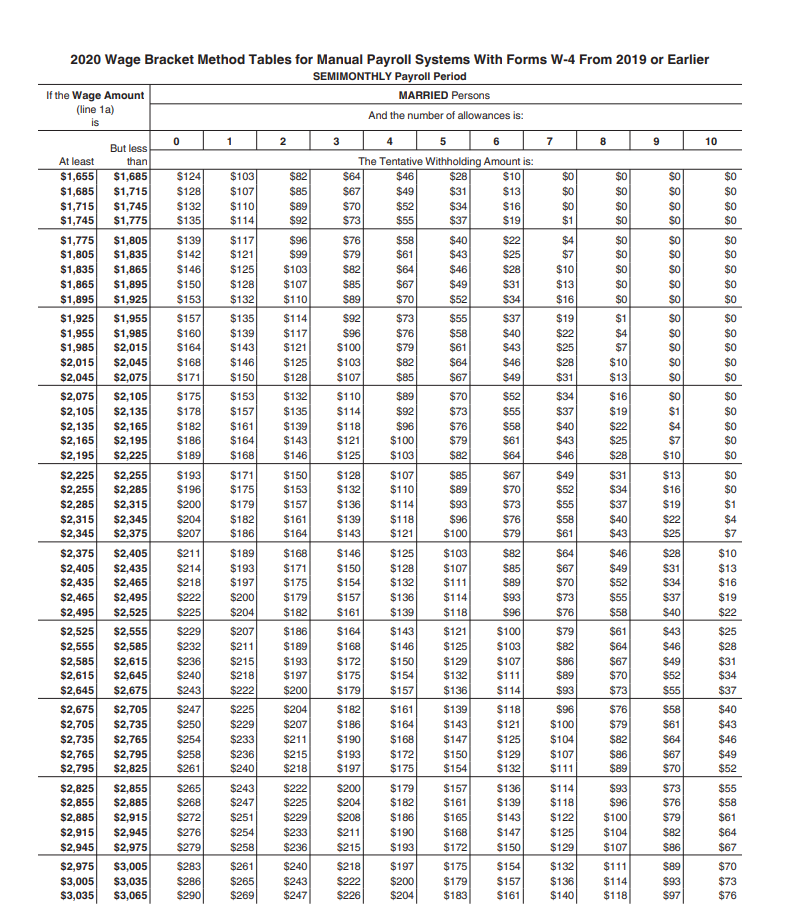

The payroll taxes for the city of San Francisco in the state of California are Federal Unemployment Insurance Tax 2021 Social Security Payroll Tax Employer Portion Medicare. Set Up a Payroll System to Withhold Taxes. You can use the IRS withholding tables or a payroll service to calculate the correct tax withholding amount.

Tax rate for nonresidents who work in San Francisco. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion California Individual Income Tax. Determine total san francisco payroll expenses.

Discover ADP For Payroll Benefits Time Talent HR More. San francisco payroll tax withholding. Skilled Attorney for Payroll Tax and Withholding in San Francisco and Throughout Santa Clara County.

And running basic payroll. Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Treasury and IRS issue final regulations on the.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Until 2018 all businesses with a taxable san francisco payroll expense greater than 150000 must file a payroll expense tax.

San Francisco CA 94107. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Payroll And Tax Compliance For Employers Aps Payroll

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

San Francisco S New Local Tax Effective In 2022

How To Calculate Payroll Taxes For Your Small Business The Blueprint

2021 Wage Base Rises For Social Security Payroll Taxes

2022 Federal State Payroll Tax Rates For Employers

Salary Paycheck Calculator Payroll Calculator Payroll Paycheck Salary

How To Calculate Payroll Taxes For Your Small Business The Blueprint

What Are Employee And Employer Payroll Taxes Ask Gusto

Payroll Tax Analyst Resume Samples Velvet Jobs

Payroll Tax Analyst Resume Samples Velvet Jobs

California Payroll Taxes Everything You Need To Know Brotman Law

2022 Federal State Payroll Tax Rates For Employers

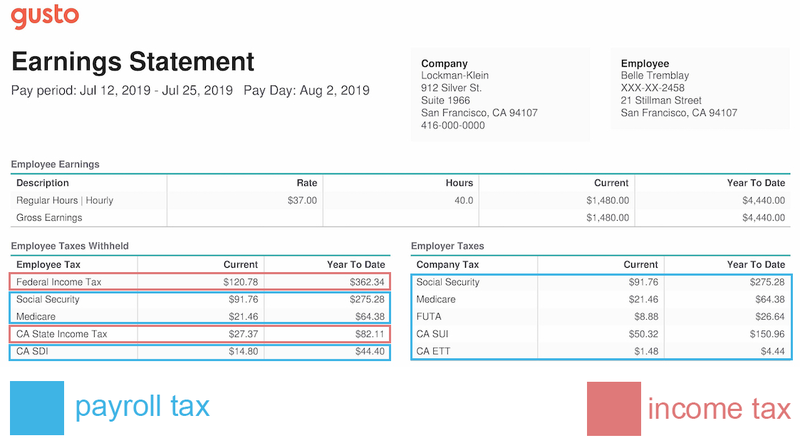

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Payroll Tax Vs Income Tax What S The Difference The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint